What are the benefits?

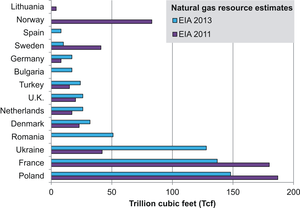

Fig. 1: Estimated technically recoverable shale resources for selected basins in some European countries (Data from U.S. EIA “World Shale Gas Resources: An Initial Assessment of 14 Regions Outside the United States", 2011 and "Technically Recoverable Shale Oil and Shale Gas Resources: An Assessment of 137 Shale Formations in 41 Countries Outside the United States”, 2013).

Fig. 1: Estimated technically recoverable shale resources for selected basins in some European countries (Data from U.S. EIA “World Shale Gas Resources: An Initial Assessment of 14 Regions Outside the United States", 2011 and "Technically Recoverable Shale Oil and Shale Gas Resources: An Assessment of 137 Shale Formations in 41 Countries Outside the United States”, 2013).Secure energy supplies

According to the U.S. Energy Information Administration (EIA) report, 2013, the United States possesses 567 trillion cubic feet (Tcf) of technically recoverable shale gas. At the 2012 rate of U.S. gas consumption, this represents enough supply for 22 years of use. In 2011, 34 % of all U.S. natural gas produced was shale gas, and this could rise to 50 % of U.S. total natural gas production in 2040, as projected in the EIA Annual Energy Outlook 2013.

Shale gas resource estimates for some European countries are shown in Fig. 1, indicating very large shale gas resources for some countries. Please note that updates of the data shown in Fig. 1 are available: Poland: 12-27 (possibly up to 67) Tcf (Polish National Geological Service; March, 2012); Germany: 11-71 Tcf technically recoverable resources (German Federal Institute for Geosciences and Natural Resources; January, 2016), U.K**: 822-2281 Tcf (British Geological Survey; July 2013), Denmark: 0-13.4 Tcf (USGS study; December, 2013), Lithuania***: 36-181 Tcf (Lazauskiene & Zdanaviciute, 2014). This could serve to secure long-term natural gas needs from a domestic source, since currently most European countries rely strongly on imports (Tab.1; only The Netherlands, Denmark and Norway are natural gas exporters).

Tab. 1: Natural gas imports of selected European countries (based on 2009 data, EIA 2011).

| Country | Imports (Exports) | Country | Imports (Exports) | |

|---|---|---|---|---|

| France | 98% | Denmark | (47%) | |

| Germany | 84% | Sweden | 100% | |

| Netherlands | (38%) | Poland | 64% | |

| Norway | (96%) | Turkey | 98% | |

| U.K. | 33% | Ukraine | 54% |

**The U.K. study does not mention a recoverability factor and the shale gas amounts refer only to GIP. A conservative estimate of the TRR would be 82-228 Tcf, or a 10% recoverability factor.

***The Lithuania study does not mention a recoverability factor and the shale gas amounts refer only to GIP. A conservative estimate of the TRR would be 3.6 – 18.1 Tcf, or a 10% recoverability factor.

Positive economic impact

Several reports have concluded that the shale gas industry in the U.S. has created a large number of jobs and has had a profound, positive economic impact, such as reducing consumer costs of natural gas and electricity, stimulating economic growth and increasing federal, state and local tax revenue.

Globally, 32 % of the total estimated natural gas resources are in shale formations (EIA, 2013). Due to its proven quick production in large volumes at a relatively low cost, extraction of shale gas resources has revolutionized the U.S. natural gas industry, providing 40 % of total U.S. natural gas production in 2012 (EIA, 2013).

“The Economic and Employment Contributions of Shale Gas in the United States”, published in December, 2011 by IHS§, concluded that in 2010 shale gas production contributed $18.6 billion in federal, state and local government tax and federal royalty revenues. Also, the study reports the shale gas contribution to GDP to have been more than $76 billion in 2010. An update of the report was published in June, 2012 (“The Economic and Employment Contributions of Unconventional Gas Development in State Economies”) that includes tight gas and coal bed methane as well as shale gas. It is assumed that the unconventional gas industry contributes more than $49 billion annually to government revenues, and will contribute $197 billion to U.S. gross domestic product by 2015. Furthermore, unconventional gas activity supported 1 million jobs in 2010 and this will grow to nearly 1.5 million jobs in 2015.

The study “Ohio’s Natural Gas and Crude Oil Exploration and Production Industry and the Emerging Utica Gas Formation - Economic Impact Study”, published in September, 2011, highlighted the economic contribution and benefits of the natural gas and crude oil industry to the State of Ohio. It included an estimate of the economic impact of planned industry spending on the development of the Utica shale gas formation. One of the findings was that “more than 204,000 jobs will be created or supported by 2015 due to exploration, leasing, drilling and connector pipeline construction for the Utica Shale reserve." A more recent study “America’s New Energy Future: The Unconventional Oil and Gas Revolution and the US Economy. Volume 2 – State Economic Contributions” published in December, 2012 by IHS, reports that the industry paid over $910 million in state and local taxes in Ohio in 2011. Moreover, the IHS study shows Ohio currently has a total of 38,380 jobs related to unconventional gas and oil activity, a number expected to increase to 143,595 in 2020 and to 266,624 by 2035.

§ Information Handling Services (IHS Inc.) serves international clients in five major areas: energy, product lifecycle, environment, security and electronics and media.

Mitigation of climate impacts

Natural gas is the cleanest burning fossil fuel. The climate impact advantage is well established for conventional natural gas, but it has been questioned for shale gas, where increased greenhouse gas emissions during production do occur. Results from recent studies indicate that the impact on climate of shale gas is only slightly higher in comparison with conventional natural gas and significantly lower than coal, when currently available best technologies are used. However, most studies explicitly state large uncertainty in some, or many, of their assumptions, and more research is needed on this topic (see SHIP “Climate Impact”).