Polish shale gas exploration: the way forward

Andrzej Rudnicki

Andrzej RudnickiAndrzej Rudnicki, Polish Geological Institute – National Research Institute PGI

July 2015

The withdrawal of U.S. major ConocoPhillips from shale gas exploration in Poland has definitely deflated the hopes for a shale gas El Dorado in Poland. Early in June 2015 the U.S. oil company announced its decision to relinquish three unconventional oil and gas exploration concessions held in Poland. Conoco drilled 7 wells and performed hydraulic fracture stimulation in Poland. According to company managers, commercial volumes of natural gas were not found (see here).

Most probably, a slump in oil and, consequently, gas prices are additional adverse factors with serious impacts on the viability of unconventional oil and gas exploration in Poland. Oil price stood at over USD 100 per barrel in the beginning of exploration boom in Poland in 2011, while as of mid-June 2015 it was less than USD 70. There are two Polish oil companies remaining in shale gas exploration: Orlen Upstream and PGNiG.

How much shale gas in Poland?

High expectations during the last years for a shale gas boom were based on optimistic but simplified resource assessments based on a comparison of the Polish and U.S. shales. However, since the start of the shale gas project Polish geologists have warned that the 2011 estimates by U.S. Energy Information Agency might be overly optimistic. The Agency's report estimated recoverable shale gas resources at as much as 5.5 Tcm.

An in-depth analysis of available pre-existing data, samples stored at the Central Geological Archives of the Polish Geological Institute and of geophysical data led to a more detailed estimate published by PGI in 2012: recoverable shale gas resources are not expected to exceed 768 Bcm (weblink to report). However, this does not mean that Poland should give up exploration and potential production.

So far, about 70 shale gas exploration wells have been drilled across Poland (Table 1, Figure 1).

Based on data available from existing wells, PGI-NRI geologists are to prepare a new report on recoverable shale gas resources by the end of 2015. Both Orlen and PGNiG plan to drill additional wells in 2015. PGNiG has just started drilling one of the new wells (Wysin-2H) in Pomerania. However, at least 100 more wells are needed to enable a more accurate estimate of these resources.

It is known that the gas occurs in the so-called shale belt stretching from Pomerania in the north to the Lublin region in the southeast of Poland. The belt is not uniform in terms of gas content. Polish geologists have long established that very large fields capable of competing with the U.S. or Chinese ones cannot be found in Poland.Polish shale gas reservoirs are located deeper (3 to 5 km) than, for example, the ones in the United States. Moreover, they are highly diverse. Some of them are rich in organic matter, which may suggest a high content of gas, but comprise clay minerals that tend to swell on contact with water and complicate the fracture stimulation operations. On the other hand, some of the shales are more brittle but contain less gas. Interview with Prof. Gregory Penkovsky, a geologist, deputy director of the Polish Geological Institute (in Polish).

Impact on the environment

Importantly, any potential shale gas production in Poland will not pose a risk to the environment. In March 2015, Polish Geological Survey published a report on environmental risks from shale gas exploration and production. The report (Press release and report in Polish, English translation of report) is based on a thorough analysis carried out by PGI specialists in collaboration with scientists from AGH University of Science and Technology and from Gdańsk University of Technology under the supervision by the Polish General Directorate for Environmental Protection. Data concerning the quality of surface and ground water, ambient air, soil, migration of fluids and gas and other environmental aspects have been collected for several years. Monitoring started before the wells were spud-in and ended two years after the stage of drilling. No damage to the environment was found.

High demand of natural gas

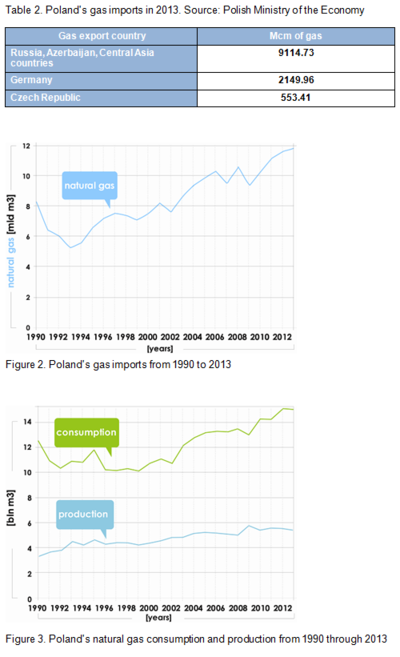

There are still prospects for development of Polish shales. As Professor Grzegorz Pieńkowski of PGI-NRI noted, should estimates by Polish Geological Survey (resources in the order 346 to 768 Bcm) prove to be correct, it would be possible to produce several billions of cubic metres of gas per year. A production volume in the order of 4-5 Bcm would satisfy approx. 30% of the domestic demand for gas and enhance Poland's energy security. Poland currently imports almost 12 Bcm of natural gas: 9 Bcm from eastern countries and almost 3 Bcm from the European Union (Table 2).

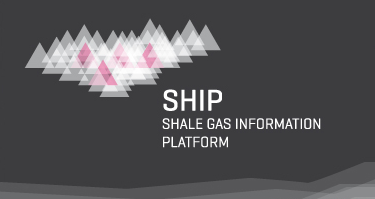

Gas imports have been growing for many years (Figure 2) to meet a steadily increasing demand. Currently, Poland consumes almost 15 Bcm natural gas per year (Figure 3). On the other hand, according to the latest “Poland's reserves of mineral resources”, as prepared by Polish Geological Institute – National Research Institute, domestic natural gas production reached 5.258 Bcm in 2014. Domestic gas production is growing at a rate lower than the demand for gas is growing (Figure 3). Accordingly, should shale gas production prove to be viable, Poland would satisfy as much as 60% of its current consumption from domestic sources with significant changes in the national gas supply structure.

Projects aiming at diversification of natural gas supply sources are being implemented alongside the studies on the potential of unconventional gas resources. These projects include the construction of a liquefied gas terminal at the port of Świnoujście. Its initial regasification capacity will be 5 Bcm per year and, on expansion, will reach as much as 7.5 Bcm per year. The terminal is to be commissioned in summer of 2015.